Pet Insurance India (March 2024) | Pet Insurance

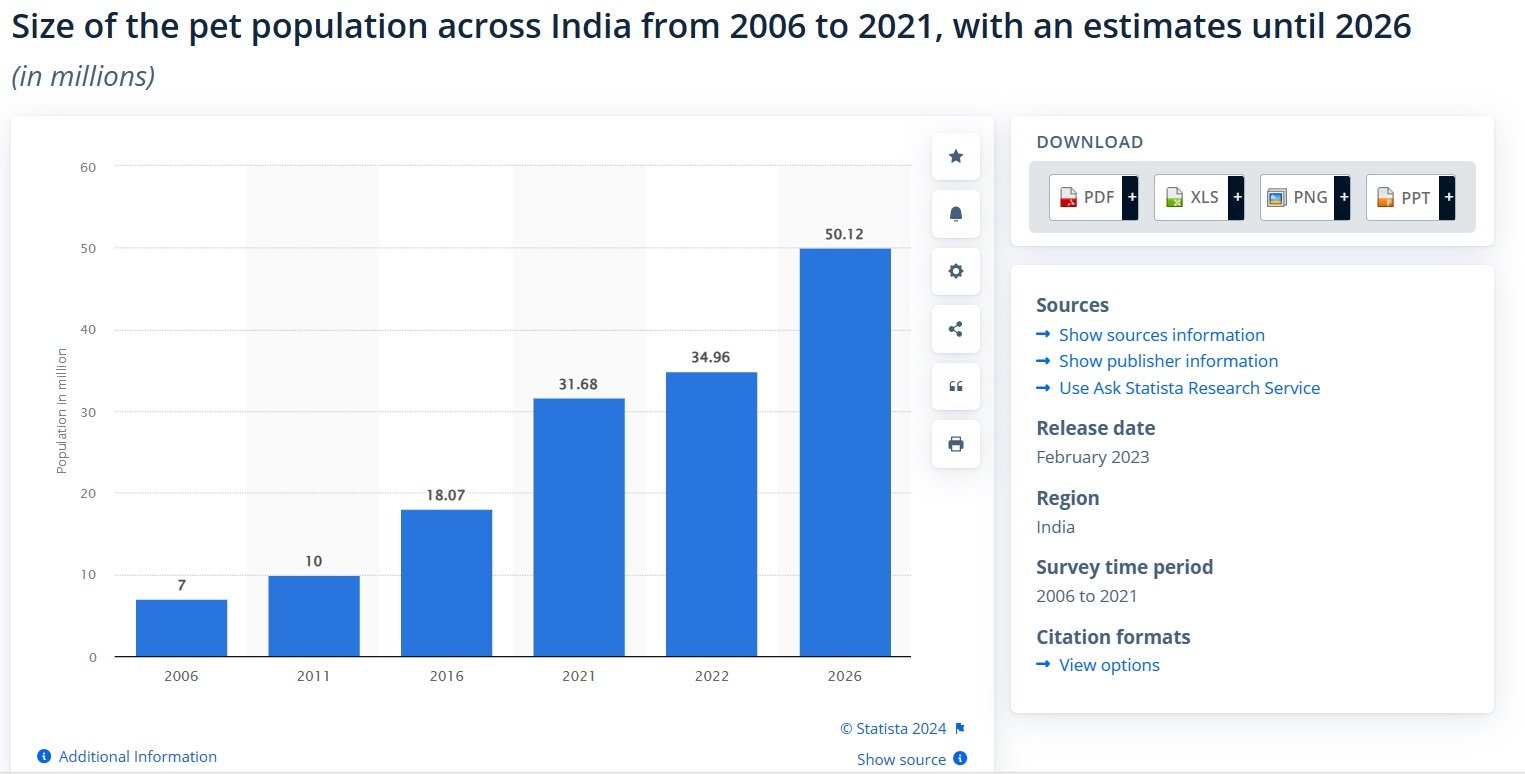

India has a large pet population, recording over 34 million in 2022 and with the potential to hit 50 million in 2026, according to Statista. Dogs comprise 68% of this population, while cats, birds, fish, and other aquatic pets comprise 34%, 16%, and 17%, respectively. However, pet insurance in India wasn’t really a popular practice until after COVID-19.

By 2022, the Times of India reported over 20 million insured pets in India, while the Indian pet care industry is valued at ₹500 crore (about $59.8 million). This valuation could hit ₹10,000 crores (approx. $1.19 billion) by 2025, signifying more interest in pet ownership in the country. While this is commendable, many are yet to understand what pet insurance is and what it covers.

In this blog post, we’ll overview pet insurance, its history and how it came into India, the types available in India, the benefits of having pet insurance, the documents needed to buy one, and the top pet insurance providers in India. This will help you better understand the pet insurance industry in 2024 and equip you to make better decisions for your furry family.

But before we begin our pet insurance India round-up 2024, let’s explain pet insurance and how it’s different from cattle insurance.

What is Pet Insurance?

Simply put, pet insurance is like our health insurance, but for pets. It is a special type of insurance that offers comprehensive protection for the health and happiness of our furry companions to ensure their general well-being. It can be paid monthly or annually and covers veterinary services like routine check-ups, emergency care and surgeries, medications, and more,

Whether it’s a cat, dog, or exotic pet, this specialized insurance ensures they receive the care they need when needed, allowing pet owners to focus on creating cherished memories with their furry friends.

Why Pet Owners Get Pet Insurance

Pet insurance offers peace of mind by covering unexpected losses due to illness, theft, or accidents. Here are some of the reasons why pet owners buy pet insurance:

- Rising Cost of Pet Care: Owning a pet comes with a hefty price tag, from costly vaccinations to regular grooming and expensive tick treatments. Market Brew estimates the cost of grooming a dog at ₹9.75 Lakh (about $11.7k) and a cat to be ₹9.61 Lakh (about $11.5k). Therefore, having pet insurance saves pet owners thousands of money.

- Standard Pet Care Budget: Pet insurance helps pet owners budget and save for pet care, especially unexpected vet visits and subsequent medical and surgical fees, which can be costly.

- Access To Licensed Veterinarians: Pet insurance encourages pet owners to visit licensed Veterinarians to ensure adequate pet care.

- To Reduce Financial Pressure: Pet insurance allows pet parents to breathe easier knowing that they won’t have to postpone Vet visits, essential procedures, or pet food purchases due to financial concerns, as the pet insurer may reimburse personal expenses.

The Difference Between Pet Insurance and Cattle Insurance

Interestingly, India has a history of insuring cattle. Cattle insurance, also known as livestock insurance, is available to nearly all Indian rural farmers to protect them against financial losses incurred due to the permanent disability or death of their cattle. It insures rural farmers from losses caused by famine, accidents, natural disasters, and more.

Cattle insurance is somewhat similar to pet insurance; however, there are differences. While pet insurance covers animals that do not serve any agricultural functions, cattle insurance covers animals reared for agriculture. These include cows, buffaloes or bullocks, pigs, goats, sheep, and chickens. Also, pet insurance does not cover animal breeding, pregnancy, or experimental treatments, unlike cattle insurance.

History of Pet Insurance and its Journey in India

While India is still new to buying pet insurance, it is a well-established practice in Western countries. Its history began in Sweden when Claes Virgin, founder of Länsförsäkrings Alliance, signed the first pet insurance policy in 1890. While the first policy focused only on horses and livestock, insurance policies only began to cover pets in the 1900s.

Britain sold its first pet insurance policy in 1947. Meanwhile, the United States sold its first policy in 1982 to Lassie, a famous TV collie offered by the Veterinary Pet Insurance (VPI) company. By 2005, many companies had flooded the market, with 500,000 insured pets recorded in the United States alone.

In 2023, Grand View Research estimated the global pet insurance market size at $11.87 billion and projected a Compound Annual Growth Rate (CAGR) of 14.15% between 2024 and 2030. Meanwhile, Europe is the largest market share holder due to its high rate of pet ownership, followed by North America and Asia Pacific.

On the other hand, it took some time for pet insurance to reach India. While there were many pet care facilities in India in the pre-COVID era, pet insurance was not popular. According to a 2011 report by Business Today, this phenomenon was due to a lack of organization in the sector. They noted that insurance companies do not advertise their services as most pets are not registered by their owners.

A city-based Veterinarian added that pets were not properly vaccinated and taken care of, causing a high mortality rate. This discouraged insurance companies from entering the market, contributing to further challenges within the industry.

Other factors that discouraged pet insurance companies include a lack of priority for pet care and pet affordability. Pet owners often abandon their pets when they can no longer afford veterinary services. Instead, they consider buying new pets since they are cheap. Meanwhile, insurance for cattle and livestock is booming since these animals provide a livelihood for their owners and can’t easily be replaced.

Consequently, pet insurance in India was relatively unknown despite its massive popularity in Western countries. It took the COVID-19 pandemic for the average Indian to consider buying pet insurance as pet owners began to treat their pets like family members. By 2022, over 19 million pets were insured in the country.

The Future of Pet Insurance in India

According to Actual Market Research, the Indian pet insurance industry has a high growth potential. The increased demand can be attributed to an increase in double-income households, lifestyle changes, urbanization, an increased number of pet adoptions, and awareness about the benefits of pet insurance.

It is expected to record a Compound Annual Growth Rate (CAGR) of 13% by 2027. This trend is expected to continue in later years as more pet owners are willing to spend money on their pets.

How Pet Insurance Works

Some insurance companies partner with veterinarians and pay them directly. In such a scenario, you’ll only be responsible for expenses that aren’t eligible for reimbursement. The steps to settle your claim are as follows:

- Inform the partnering veterinary hospital at least 72 hours before any planned medical treatment, except for emergencies.

- Present your E-Cards and ID proof at the veterinary hospital to receive the pre-authorization form.

- Complete and sign the pre-authorization form and submit it to the veterinary hospital.

- After completing the formalities, your insurance provider will pay the bills directly to the hospital.

However, most pet insurance works on a reimbursement basis. Here, you’ll cover the veterinary services upfront and later submit a claim for eligible costs to be refunded. While the claims filing and reimbursement process may differ in some cases, here are the general steps:

- Schedule an appointment with your pet’s Veterinarian.

- Take your pet to the Veterinarian’s office and cover the total cost of the services rendered.

- Submit your claim online or through the pet insurer’s mobile app, attaching a copy of the veterinary bill.

- Upon approval from the pet insurance company, you’ll receive your eligible reimbursement via direct deposit or a traditional paper check sent by mail.

Note that the review and approval timeframe can vary from a few days to several weeks or even a month based on the insurer, policy details, and the complexity of the incident or illness.

Features of Pet Insurance India

- While you can insure birds, fish, and exotic animals, the two main kinds of pet insurance coverage in India are dog insurance and cat insurance.

- Pet insurance is regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

- Pet owners can customize their pet insurance based on their pet’s needs.

- All insured pets must be registered with the recognized municipal or local government authority or certified by the Kennel Club of India (for dogs). Pets bought from breeders carry a Transfer of ownership certificate that can be used to register the pet.

- Deductible: The amount a pet owner pays out of pocket before the insurance kicks in. It could be annual or incident based.

- Reimbursement Percent: Typically ranging from 60% to 90%, this percentage determines the portion of eligible costs the insurance company will cover.

- Coverage limit: Pet insurers have a maximum amount payable within a specified time frame. It could be on an annual, incident, or lifetime basis. Some insurers offer unlimited coverage for higher premiums.

- Sum assured: The pre-fixed amount that an insurance provider gives a policyholder or their heir when an insured event occurs in exchange for premiums. The amount depends on the pet breed and other factors. It usually has a co-payment clause where the insurer pays 80% of the insured sum, and the pet owner pays 20%.

- Premium: According to Indian policy standards, the general premium paid for a pet insurance policy range from 3% to 5% of the sum assured.

Types of Pet Insurance Available in India

Pet Insurance companies in India offer different insurance plans for pets. These are: options encompass lifetime coverage, time-limited coverage, or money-limited coverage.

- Lifetime Coverage: The insurer pays the pet parent a certain amount annually for the pet’s treatment throughout its lifespan.

- Time-limited Coverage: The insurer pays only for the duration of a contracted illness or injury.

- Money-limited Coverage: Pet owners can use this coverage until they reach the specified money limit agreed in the policy.

- Accident-only Coverage: This policy only covers the cost of treatment after an accident or other medical emergencies, such as when your pet gets hit by a car, bitten by another animal, or swallows a harmful object.

- Accident and Illness Coverage: This plan is comprehensive but costly. It extends to diagnosing, treating, and managing daily illnesses and conditions like cancer, diabetes, arthritis, and certain genetic diseases.

- Wellness Coverage: This plan add-on covers regular and preventive care, such as dental care, diagnostic tests, wellness exams, vaccines and medications, and neutering. Sometimes, microchipping is added to the plan.

After enrolling your pet in any of these coverages, there are waiting periods before the insurance coverage becomes effective. Typically, accident-only waiting periods are brief, lasting up to 15 days, whereas accident-illness waiting periods may extend up to 30 days. Although uncommon, certain insurers provide pet insurance without any waiting period for accident coverage.

Pet Insurance India Inclusions and Exclusions

| What Pet Insurance Covers | What Pet Insurance Does Not Cover |

| Emergency care – Emergency room visits and Urgent medical services. | Injuries from organized fights or racing (e.g. Greyhound racing and pit bull fighting). |

| Diagnostic tests – X-rays, Blood tests, MRIs, Ultrasound | Grooming – routine grooming e.g. haircuts, baths, nail trimmings |

| Surgeries – Routine procedures (e.g. spaying and neutering), Complex operations (e.g. Orthopedic surgeries) | Training classes and behavior modification programs (unless covered by a wellness plan). |

| Medications needed for medical conditions | Cosmetic or elective procedures e.g. ear cropping, and tail docking. |

| Accidents and injuries | Breeding-related expenses like fertility treatments, pregnancy, artificial insemination, and stud fees. |

| Illnesses e.g. infections, and congenital disorders | Pre-existing conditions – medical conditions that occurred before policy activates or during the waiting period |

| Chronic conditions (e.g. diabetes, cancer, allergies) | Pet loss due to carelessness |

| Vet visits | Pet boarding costs |

| Hospitalization | Preventive care not covered by a wellness plan |

| OPD Cover | Experimental treatments |

| Lost, stolen, or strayed pets | Burial or cremation (unless covered by a wellness plan) |

| Third-party liability | Special pet food or supplement |

| Dental care, vaccinations, parasite prevention and treatment, and annual examinations (included as add-ons) | DNA testing |

| Examination fees | |

| Euthanasia or end-of-life care | |

| Rehabilitation | |

| Hereditary and congenital conditions |

Benefits of Pet Insurance

- Best health and medical care for your pet

- Affordable expenses

- Savings on extra expenses

- Easy to budget for pet care

- Enjoy coverage for accidents or illness and prompt medical assistance

- Coverage for third-party damages

- Some plans cover routine check-ups and vaccinations

- Save up to 90% on veterinary services

- Reduce financial strain

- Best safety net for emergency expenses

- It gives pet owners peace of mind knowing they are protected from unforeseen medical emergencies.

- Customizable policy options to meet specific needs and budget

- It helps to sustain the pet’s lifespan and prevent premature death

What is The Cost of Pet Insurance in India?

Pet owners can insure their pups and kittens at 8 weeks old. While pet insurance costs vary, the average price ranges from ₹15,000 ($179) to ₹30,000 ($358), according to Market Brew. This cost is influenced by the pet’s age, size, breed, existing health conditions, and even the place of residence. Other factors are the annual coverage limit and deductible offered by the insurer. On average, pet owners can expect to allocate around 5-6% of their expenses towards insurance, with premiums typically rising as the pet ages.

How to Choose the Best Pet Insurance for Your Pet

Buying pet insurance in India is straightforward. It can be done online through an insurance company’s website or using an insurance aggregator platform. However, before purchasing pet insurance, do adequate research and gather multiple quotes for comparison. Carefully choose a deductible, a reimbursement percentage, and an annual limit, as they directly influence your premium and the coverage you’ll receive.

Also, preferences like round-the-clock veterinary assistance, absence of age restrictions, direct payment options, and waiting periods for accidents and illnesses should be considered. This way, you can identify the most cost-effective policy that best suits your specific circumstances and coverage needs. The good news is that many companies are in the market, so you have many options.

Documents Needed to Buy Pet Insurance in India

Pet owners are to submit the following documents while purchasing pet insurance in India:

- Pet registration certificate and ID.

- A duly filled and signed insurance proposal form.

- A color photograph of the pet that clearly shows its face, birthmark, and five sides: left, right, front, back, and top. Pets with an RFID chip will require a color photo clearly showing the identification number. The photograph should show the newspaper on the application day and the date.

- Vaccination certificates

- Health certificate from a licensed Veterinarian

- Sometimes diagnostic test results, such as chest X-ray, circulatory blood count (CBC), or urine test, may be required, especially for older pets.

- If a pet owner chooses to insure a sum higher than the pet’s pedigree lineage, a pedigree certificate issued by the Kennel Club of India (KCI) is required.

- If the pet owner wants a sum insured higher than the maximum price for the pet breed, they must provide proof of purchase.

Top Providers of Pet Insurance in India in 2024

Below is an overview of some of India’s best pet insurance providers.

| The New India Assurance Company Limited | |

| Animal Coverage | Dogs of indigenous origin/cross-bred/exotic breeds |

| Entry age | 8 weeks to 8 years |

| Percentage Deductible | 20% of the claim amount |

| Minimum premium | 5% of the sum insured |

| Inclusions | Death due to accidents or illness, Lost or stolen pets (due to burglary or house break), Third-party Liability for personal injuries and damage to property |

| Exclusions | Intentional injury or neglect, intentional slaughter, war, death due to lack of vaccination, third-party personal injury, transport by air and sea, and diseases gotten before coverage activation. |

| Waiting period | 90 days |

| Oriental Insurance Company Limited | |

| Animal Coverage | Indigenous, crossbred, or exotic dogs, watchdogs, sheepdogs, and hunting dogs. |

| Entry age | 8 weeks to 8 years |

| Percentage Deductible | 20% of the claim amount |

| Minimum premium | 6% of the sum insured |

| Inclusions | Death caused by illness or accident, vaccinations, tick treatments, loss of entry fees for show dogs, death by accident in transit, lost or stolen dogs. |

| Exclusions | Partial and permanent disability of any nature due to lack of vaccinations. |

| Waiting period | 90 days |

| Bajaj Allianz General Insurance Company Limited | |

| Animal Coverage | Indigenous, crossbred, or exotic dogs. Cats of all breeds. |

| Entry age | A. Dog – 3 months to 7 years, depending on the dog size.

B. Cat – 3 months to 7 years |

| Percentage Deductible | 10% of every claim |

| Minimum premium | ₹315 |

| Inclusions | Pet vaccination, hospitalization, surgery expenses, mortality benefit, long-term care, OPD cover, terminal diseases, Third-Party Liability, theft/loss/ straying. |

| Exclusions | Surgeries not necessitated due to accidents/illnesses, death due to aggression (unless attributed to an illness), diseases that vaccines/preventive medicines have not been taken for. |

| Waiting period | A. Normal cases: 90 days.

B. None for accidents. |

| Future General Dog Health Insurance | |

| Animal Coverage | All dog breeds |

| Entry age | 3 months to 10 years |

| Percentage Deductible | 10% of every claim |

| Minimum premium | ₹323 per month |

| Inclusions | A. Death due to accident or illness, pre-hospitalization and post-hospitalization expenses, funeral expenses, surgery and treatment costs, etc.

B. Optional add-ons like third-party liability, lost or stolen pet cover, doctor on call, etc. |

| Exclusions | Pre-existing diseases, cosmetic treatment, treatment taken during the waiting period, Congenital Abnormalities, and Dental treatment. |

| Waiting period | 30 days. |

| Go Digit General Insurance Limited | |

| Animal Coverage | Dogs and cats |

| Entry age | 4 months to 10 years |

| Percentage Deductible | Varies based on policy coverage with a minimum of 5% on sum insured |

| Minimum premium | ₹1,879 |

| Inclusions | Death due to accident or illness, third-party liability, theft or straying, expenses for external aids or appliances, recovery care, chronic illness, telemedicine cover, OPD, Hospitalization, critical illness. |

| Exclusions | A. Any injury/illnesss caused by participating in any events, contests, competitions, racing, or organized fighting

B. Medication not recommended by vet, pre-existing health conditions, euthanasia. |

| Waiting period | 30 days for illness |

You may find a comparative chart below for your easy reference-

| S/N | Name | Animal Coverage | Entry age | Percentage Deductible | Minimum premium | Inclusions | Exclusions | Waiting period |

| 1. | The New India Assurance Company Limited | Dogs of indigenous origin/cross-bred/exotic breeds | 8 weeks to 8 years | 20% of the claim amount | 5% of the sum insured | Death due to accidents or illness, Lost or stolen pets (due to burglary or house break), Third-party Liability for personal injuries and damage to property | Intentional injury or neglect, intentional slaughter, war, death due to lack of vaccination, third-party personal injury, transport by air and sea, and diseases gotten before coverage activation. | 90 days |

| 2. | Oriental Insurance Company Limited

|

Indigenous, crossbred, or exotic dogs, watchdogs, sheepdogs, and hunting dogs. | 8 weeks to 8 years | 20% of the claim amount | 6% of the sum insured | Death caused by illness or accident, vaccinations, tick treatments, loss of entry fees for show dogs, death by accident in transit, lost or stolen dogs. | Partial and permanent disability of any nature due to lack of vaccinations. | 90 days |

| 3. | Bajaj Allianz General Insurance Company Limited

|

Indigenous, crossbred, or exotic dogs.

Cats of all breeds. |

Dog – 3 months to 7 years, depe-nding on the dog size.

Cat – 3 months to 7 years |

10% of every claim | 315 | Pet vaccination, hospitalization, surgery expenses, mortality benefit, long-term care, OPD cover, terminal diseases, Third-Party Liability, theft/loss/ straying. | Surgeries not necessitated due to accidents/illnesses, death due to aggression (unless attributed to an illness), diseases that vaccines/preventive medicines have not been taken for. | 90 days.

None for accidents. |

| 4. | Future General Dog Health Insurance

|

All dog breeds | 3 months to 10 years | 10% of claim amount | 323 per month | Death due to accident or illness, pre-hospitali-zation and post-hospitalization expenses, funeral expenses, surgery and treatment costs, etc.

Optional add-ons like third-party liability, lost or stolen pet cover, doctor on call, etc. |

Pre-existing diseases, cosmetic treatment, treatment taken during the waiting period, Congenital Abnormalities, and Dental treatment. | 30 days |

| 5. | Go Digit General Insurance Limited | Dogs and cats | 4 months to 10 years | Varies based on policy coverage with a minimum of 5% on sum insured | ₹1,879 | Death due to accident or illness, third-party liability, theft or straying, expenses for external aids or appliances, recovery care, chronic illness, telemedicine cover, OPD, Hospitalization, critical illness. | Any injury/illnesss caused by participating in any events, contests, competitions, racing, or organized fighting

Medication not recommended by vet, pre-existing health conditions, euthanasia. |

30 days for illness |

Conclusion

Experts anticipate the pet insurance in India will grow as more people recognize the benefits of having pet insurance. With pet insurance, pet owners can comfortably afford most medical and health expenses throughout their pet’s lifespan. Proper care should be taken while choosing the best pet insurance for your needs and budget.